Liquid Hydrogen Market Size, Share, and Growth Analysis

Read Time: 0 minutes

Liquid Hydrogen Market Insights

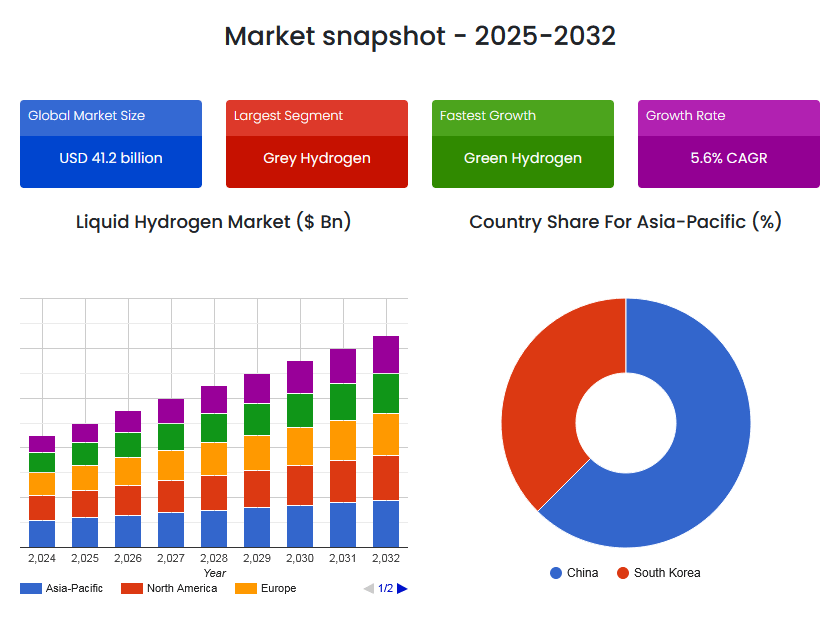

Global Liquid Hydrogen Market size was valued at USD 40.34 billion in 2023 and is poised to grow from USD 42.73 billion in 2024 to USD 66.08 billion by 2032, growing at a CAGR of 5.6% during the forecast period (2025-2032).

Rapid technological advancements, government subsidies for clean fuels and changes in energy policies are driving the global liquid hydrogen market growth. Decarbonization and the construction of hydrogen infrastructure are top priorities for future governments worldwide, with a particular focus on liquid hydrogen for use in large-scale energy storage, transportation and aircraft.

- For instance, Japan extended its Hydrogen Society program by establishing a nationwide network for the distribution and fueling of liquid hydrogen which is expected to be completed by 2024. This network serves hydrogen-powered vehicles and industrial applications by providing cryogenic refueling stations, cutting-edge transport pipelines and on-site storage tanks. To lower carbon emissions and ensure long-term energy resilience until 2025, this deployment is being supported, by public-private partnerships with businesses such as Kawasaki Heavy Industries and Iwatani Corporation. The initiative is a component of Japan broader plan to become carbon neutral and take the lead in the global hydrogen economy.

A few technological advancements have led to the growth of the liquid hydrogen industry worldwide. The cost and energy intensity of hydrogen liquefaction have been greatly decreased by advanced liquefaction techniques and AI-driven process optimization increasing its commercial viability. Due to the growth of modular hydrogen production units and the construction of green hydrogen plants, that use renewable energy, the market is moving towards sustainable hydrogen ecosystems in 2024.

Why Is AI Integration Essential for the Next-Gen Liquid Hydrogen?

The global liquid hydrogen market outlook is changing as artificial intelligence (AI) plays a key role in streamlining the production, distribution and storage of liquid hydrogen. To improve system efficiency, safety and return on investment, AI-powered platforms examine data such as, energy demand projections, the availability of renewable energy, cryogenic storage performance and transportation logistics.

For instance, the Chubu region of Japan, installed AI-integrated hydrogen refueling hubs in 2024 and 2025. These hubs automatically modify storage pressure and liquefaction rates in response to real-time vehicle inflow and ambient temperature. Like this, an AI-enabled hydrogen plant in Germany that was inaugurated in March 2025 monitors cryogenic tanks, looks for irregularities and minimizes energy loss during storage and transfer by using sensor-driven analytics and predictive maintenance.

To get more insights on this market click here to Request a Free Sample Report

Liquid Hydrogen Market Segments Analysis

Global Liquid Hydrogen Market is segmented by Production Method, Distribution Method, End-Use Industry and region. Based on Production Method, the market is segmented into Steam Methane Reforming (SMR), Electrolysis and Others. Based on Distribution Method, the market is segmented into Pipelines, Cryogenic Tanks and Others. Based on End-Use Industry, the market is segmented into Aerospace / Rocket Propulsion, Industrial Processes, Energy Storage & Power Generation, Transportation, Electronics, Chemicals & Petrochemicals, Refining, Metals, Glass and Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

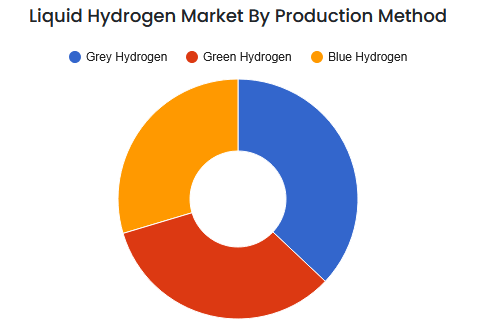

Why is Liquid Hydrogen Market Dominated by Grey Hydrogen?

Due to its affordability and pre-existing infrastructure, grey hydrogen continues to be the largest contributor to the world liquid hydrogen supply according to current liquid hydrogen industry analysis. Despite being carbon-intensive, it is still widely used in areas with less developed clean hydrogen frameworks. It is made from natural gas using steam methane reforming (SMR). For instance, in parts of North America and Asia, several industrial facilities still rely on grey hydrogen as an interim energy solution until green hydrogen becomes economically viable.

The production method category fastest-growing subsegment is green hydrogen, which is made by electrolysis using renewable energy. Governments and energy companies are making significant investments, in green hydrogen plants in response to growing pressure to lower carbon emissions. One prominent instance is the NEOM project in Saudi Arabia, which plans to export liquid hydrogen worldwide and become the largest green hydrogen hub in the world by 2026.

Why Is Global Liquid Hydrogen Market Dominated by Aerospace?

Given its long-standing use of liquid hydrogen as a rocket propellant, the aerospace industry, currently controls the largest share of the global liquid hydrogen market. Since liquid hydrogen has a high energy density and burns cleanly space agencies like NASA and businesses like SpaceX and Blue Origin continue to use it for high-thrust, deep-space missions.

The market for liquid hydrogen is expanding at the fastest rate in the mobility segment, which includes hydrogen-powered trucks, buses, trains and fuel-cell electric vehicles (FCEVs). Mobility is a major factor in the future of the liquid hydrogen market growth since governments around the world are funding infrastructure for hydrogen refueling and promoting zero-emission transportation.

To get detailed segments analysis, Request a Free Sample Report

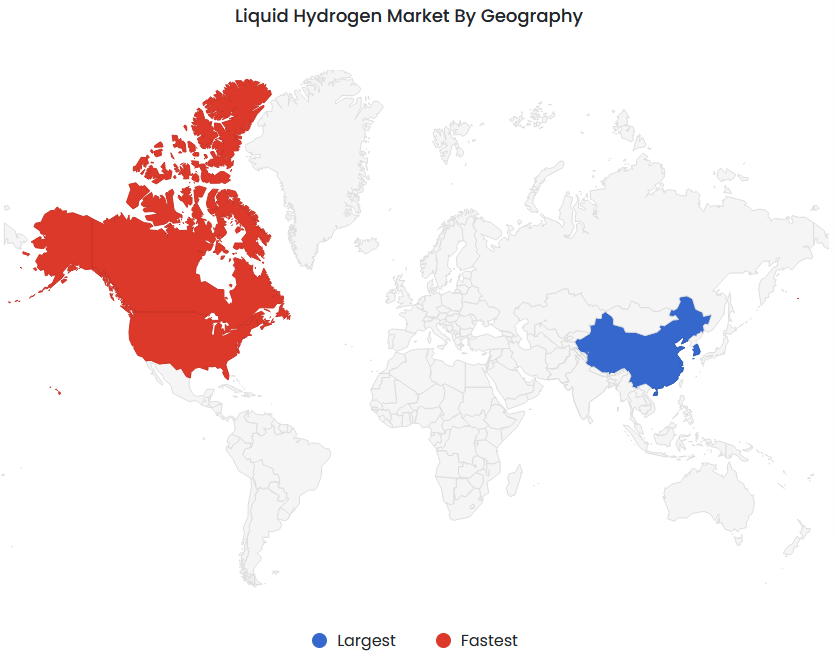

Liquid Hydrogen Market Regional Insights

Why Is Global Liquid Hydrogen Market Dominating by Asia-Pacific?

Asia-Pacific dominates the global liquid hydrogen regional outlook, holding the largest market share in terms of production, consumption, and infrastructure development, according to the regional outlook for 2024. Japan, South Korea, China, and Australia are among the nations making significant investments in cryogenic storage and transportation systems, liquid hydrogen facilities, and electrolyzes powered by renewable energy sources. In 2025, Japan launched the world first commercial-scale liquid hydrogen cargo ship and South Korea expanded its urban hydrogen mobility plan with citywide liquid hydrogen stations in Seoul, Busan and Ulsan.

China Liquid Hydrogen Market

China is rapidly scaling up liquid hydrogen deployment across industrial zones and clean energy hubs. Several state-owned companies and startups are investing in large-scale hydrogen production via solar and wind-powered electrolysis. In 2025, the Yunnan Hydrogen Corridor project began liquefying green hydrogen for export and use in electric cargo trains, demonstrating China’s commitment to hydrogen dominance.

South Korea Liquid Hydrogen Market

With a focus on liquid hydrogen for export and transportation, South Korea has made rapid progress on its hydrogen roadmap. The largest liquid hydrogen production facility in Asia was unveiled in 2025 by Hyosung and Linde Korea, and it will supply hydrogen to local fleets as well as export to nearby areas. By 2030, the government plans to have 70 liquid hydrogen stations and 30,000 hydrogen-powered commercial vehicles.

Why Is North America the Fastest Growing Region in the Liquid Hydrogen Market?

As per liquid hydrogen market outlook, North America is emerging as the fastest-growing region in the global liquid hydrogen market. This acceleration is fueled by ambitious clean energy mandates, large-scale hydrogen infrastructure funding, and corporate adoption of hydrogen-based mobility and energy storage. In the U.S., the Department of Energy’s Hydrogen Shot Initiative has led to several liquid hydrogen pilot projects in transportation, aerospace and industrial decarbonization.

U.S. Liquid Hydrogen Market

The U.S. market is driving growth through a mix of public-private partnerships and clean hydrogen incentives. The construction of liquid hydrogen corridors for long-haul trucks across Interstates 5 and 95, which was made possible by funding from the Bipartisan Infrastructure Law is a noteworthy example. To satisfy demand both domestically and internationally new liquefaction facilities are also expanding in Texas and California.

Canada Liquid Hydrogen Market

Canada is experiencing rising interest in liquid hydrogen as part of its Net-Zero Emissions by 2050 plan. Hydro-powered electrolysis is being used in projects in British Columbia and Quebec to produce green hydrogen, which is then liquefied for use in fuel cell buses, trains and international shipping. Canada has a competitive advantage in becoming a major supplier of liquid hydrogen to both North America and Europe because of its advantageous location and wealth of renewable energy.

How is the European Market For Liquid Hydrogen Balancing Innovation?

Europe is closely trailing North America due to its drive for a hydrogen-centric energy transition. The region is quickly improving its infrastructure for production, storage and distribution with initiatives like France’s liquefied hydrogen-powered transportation pilots and Germany’s Hydrogen Backbone. The European Hydrogen Bank, announced subsidies for mobile cryogenic tankers and liquid hydrogen terminals in 2025 with the goal of promoting decentralized energy storage, shipping, and aerospace throughout the European Union.

UK Liquid Hydrogen Market

The UK market is focused on transitioning its industrial clusters and transport corridors to hydrogen. The Teesside Hydrogen Hub started producing liquid hydrogen for regional fuel cell buses and ferries in 2024 as a pilot project. In keeping with the nation’s zero-emissions targets National Grid Hydrogen also revealed plans to incorporate liquid hydrogen into energy storage facilities and backup power systems.

Germany Liquid Hydrogen Market

Germany is leading the European push for liquid hydrogen. Through partnerships with Siemens Energy, Linde, and BMW the country is investing in massive liquefaction plants and refueling networks. In 2025, Hamburg’s automated liquid hydrogen storage terminal went online, providing safe and scalable solutions for transportation and stationery applications.

France Liquid Hydrogen Market

France continues its innovation in aerospace-focused hydrogen use. Air Liquide’s expansion into liquid hydrogen mobility is supporting public buses and even hydrogen-powered metro prototypes. The 2024 Paris Olympics showcased liquid hydrogen refueling stations, which are now being expanded to serve other urban transit zones.

To know more about the market opportunities by region and country, click here to Buy The Complete Report

Liquid Hydrogen Market Dynamics

Liquid Hydrogen Market Drivers

Liquid Hydrogen for Space Travel

- The increasing investment in space program further supports the need for liquid hydrogen. With nations like India, successfully testing cryogenic engines for missions like Chandrayaan-3 space agencies around the world are increasing their launch capabilities. The industry dedication to sustainable space exploration is demonstrated by the European Space Agency announcement of its, new rocket launcher, Ariane 6, which switches from grey to green hydrogen while preserving the vital role that, liquid hydrogen plays in propulsion systems.

Developments in Hydrogen Infrastructure

- The widespread use of liquid hydrogen in the transportation, energy and industrial sectors depends on the development of a strong hydrogen infrastructure that includes systems for production, storage, liquefaction and distribution. The cost and complexity of handling hydrogen have been greatly reduced in recent years by large investments in electrolysis plants, cryogenic storage technology, and high-efficiency liquefaction units. This integrated approach is allowing end users like public transportation, aerospace, and backup energy providers to rely on a reliable and scalable hydrogen supply while also speeding up liquid hydrogen market penetration and opening the liquid hydrogen value chain to new players.

Liquid Hydrogen Market Restraints

High Production and Liquefaction Costs

- The high cost of producing and liquefying hydrogen is one of the main factors limiting the market for liquid hydrogen. Electrolysis still requires a lot of energy to produce green hydrogen, especially when compared to grey hydrogen, which is hydrogen derived from fossil fuels. Hydrogen must also be cooled to -253°C to be liquefied, which uses a lot of energy and costly cryogenic equipment.

- In comparison to compressed hydrogen and traditional fuels this leads to limited cost competitiveness. According, to the most recent liquid hydrogen industry analysis increasing liquefaction efficiency and expanding renewable capacity are essential to the economic feasibility of liquid hydrogen.

Challenges with Storage and Transportation

- Due to its low density and extremely high cryogenic requirements, hydrogen is particularly difficult to store and transport. Modern insulated tanks and constant monitoring are necessary to maintain the extremely low temperatures needed for liquid hydrogen to prevent boiloff losses. Safety concerns are also raised by leaks and embrittlement problems in pipelines and storage tanks particularly in populated or urban areas.

Request Free Customization of this report to help us to meet your business objectives.

Liquid Hydrogen Market Competitive Landscape

There is fierce competition among regional and international companies, in the liquid hydrogen market that are committed to sustainability and innovation. Important businesses are making significant investments, in liquefaction systems electrolysis technology and cryogenic storage advancements to obtain a competitive advantage. Strategic actions like joint ventures and mergers and acquisitions, are assisting businesses in expanding their hydrogen portfolios across industries like power generation, mobility and aerospace, strengthening supply chains and speeding up market entry. As high-performing companies aim to lead not only through capacity but also by influencing standards, safety advancements, and next-generation hydrogen delivery systems, these liquid hydrogen market strategies are setting the stage for long-term success.

- Founded in 2015, NEOEx Systems, in USA), a pioneer in using liquid hydrogen for UAVs (drones). Their EXTEND Energy & Power System delivers up to 20× longer flight durations compared to battery-powered drones. They have secured defense contracts including NOAA to power long-range weather and surveillance UAVs.

- Founded, 2020, Universal Hydrogen, in USA, building an end-to-end hydrogen logistics network for aviation transporting hydrogen in modular capsules that can be loaded onto planes. By 2025 they are targeting zero-emission regional passenger service

Top Player’s Company Profiles

- Air Liquide SA

- Linde plc

- Air Products and Chemicals, Inc.

- Iwatani Corporation

- Plug Power Inc.

- Philomaxcap AG (GenH2 orporation)

- Messer Group GmbH

- Mitsubishi Chemical Group Corporation

- Fortescue Metals Group

- Shell PLC

Recent Developments in Liquid Hydrogen Market

- In April 2025, Air Liquide’s 20 MW PEM electrolyzer in Oberhausen, Germany, launched in 2024, is now connected to Air Liquide’s pipeline network and gradually supplying renewable hydrogen to local industrial and mobility customers. This is the largest electrolyzer in Germany connected to existing infrastructure and can produce up to 2,900 tons of hydrogen per year.

- In March 2025, INOX Air Products commissioned India’s first green hydrogen plant for the float glass industry at Asahi India Glass Limited’s (AIS) new greenfield facility in Soniyana, Chittorgarh, Rajasthan. The solar-powered plant has a capacity of up to 190 tons of green hydrogen per annum via electrolysis. In phase one, 95 tons per year will be supplied to AIS under a 20-year offtake agreement.

- In May 2024, Air Products announced to build the network of commercial-scale multi-modal hydrogen refueling stations connecting northern and southern California. The HRS will further have a capacity to fuel 200 heavy duty trucks or 2,000 light duty vehicles per day. Additionally, the firm has allocated over USD 15 Billion towards clean energy initiatives which have positively impacted the shift in energy usage while achieving the prescribed climate objectives.

Liquid Hydrogen Key Market Trends

- Including Green Hydrogen in Supply Chains for Liquefaction: The incorporation of green hydrogen generated through electrolysis powered by renewable resources into liquefaction and distribution networks is a significant trend revolutionizing, the liquid hydrogen market. Countries are investing in environmentally friendly hydrogen hubs where large-scale hydrogen production is powered by renewable energy sources (such as solar and wind) and liquefied on-site, because of the acceleration of global decarbonization goals.In addition to improving sustainability, this makes projects eligible for clean energy subsidies, particularly in North America and Europe which increases investor interest and the liquid hydrogen market size.

- Growth of Liquid Hydrogen in Heavy Mobility and Aerospace: The increasing use of liquid hydrogen in long-haul trucking, marine, and aerospace is another significant trend. Liquid hydrogen solutions for fuel-cell aircraft, space launches and hydrogen-powered commercial fleets are being piloted by organizations such as NASA, Airbus and Toyota. It is perfect for industries, where compressed hydrogen is insufficient due to its high energy density and capacity to support long-range applications. The market’s high-value applications are growing because of the quick technological advancements in lightweight tanks, cryogenic storage and refueling infrastructure.

Liquid Hydrogen Market SkyQuest Analysis

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the growing demand for clean energy, decarbonization initiatives and improvements in hydrogen infrastructure are all driving the global market for liquid hydrogen. Due to its high energy density and capacity for long-distance transportation liquid hydrogen is perfect for heavy mobility, shipping and aerospace applications. Significant investments in cryogenic storage, liquefaction technologies and green hydrogen production, are improving scalability and lowering operational difficulties. While Asia-Pacific continues to be a crucial center for innovation North America is the region with the fastest rate of growth. Market penetration is being accelerated by smart logistics networks hydrogen corridors and public-private partnerships. Liquid hydrogen is emerging as a key facilitator of the global transition to a low-carbon future as nations commit to net-zero goals.

| Report Metric | Details |

|---|---|

| Market size value in 2023 | USD 40.34 billion |

| Market size value in 2032 | USD 66.08 billion |

| Growth Rate | 5.6% |

| Base year | 2024 |

| Forecast period | 2025-2032 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements

for quicker decision making. This platform allows you to compare markets, competitors who are prominent

in the market, and mega trends that are influencing the dynamics in the market. Also, get access to

detailed SkyQuest exclusive matrix.

Methodology

For the global liquid hydrogen market, our research methodology involves a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

Information Procurement: This stage involved the procurement of market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover’s, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the global liquid hydrogen market.

Report Formulation: The final step entailed placing data points in appropriate market spaces to draw viable conclusions.

Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the global liquid hydrogen market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the global liquid hydrogen market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high growth end-users to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply markets which will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To Analyse the conversations and trends happening not just around your brand, but around your industry, and using those insights to make better marketing decisions.

This is a repost from Liquid Hydrogen Market.